home

about

properties

contact

blog

Market Insights

December 15, 2022

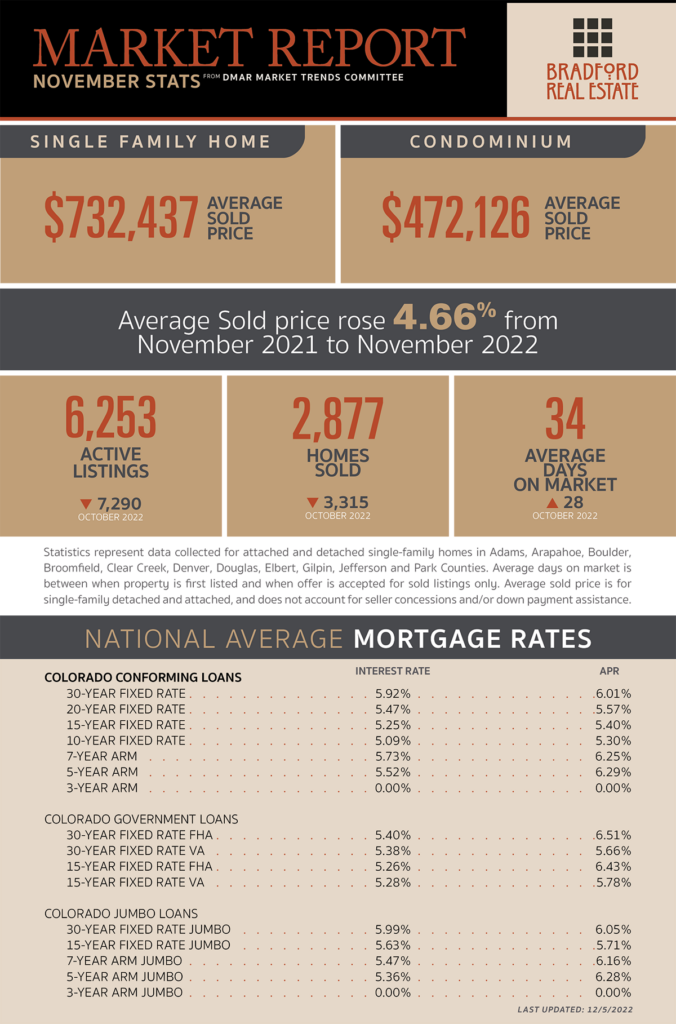

As published in DMAR Market Trends, December 2022

Down payment assistance programs can significantly reduce the cash-to-close delta for a buyer who may or may not be required to be repaid. These programs could make all the difference in being able to own now, during the window of opportunity that exists through the end of the year.

Colorado officials want to bring the state’s biggest buildings in line with its climate goals. Owners and managers of most buildings over 50,000 square feet had until December 1, 2022, to report their energy usage to the state.

A Denver City Council committee approved a series of measures that city staff say will accelerate a long-planned bus rapid transit line on East Colfax Avenue. The project is now slated for completion by 2026, 18 months sooner than originally planned.

Mayor Michael Hancock’s ambitious plan to build 125 miles of bike lanes in Denver by 2023 is on track to exceed its goal The goal of the plan is to build out the bikeway network so all residents are within a two-minute ride (or quarter mile) of a bikeway that they feel safe and comfortable riding.

The National Association of Realtors®’ annual Profile of Homes Buyers and Sellers showed that first-time homebuyers made up 26% of buyers, down from last year’s 34%—the lowest share of first-time buyers since the data collection began. The report also showed that the typical first-time buyer is now 36 years old, a new all-time high.

A large cohort of 28- to 38-year-olds in prime homebuying age will drive purchase business in the next three to five-years. Historically low delinquency rates will mean more borrowers will be eligible for a new purchase or refinance loans.

MORTGAGE NEWS

October and November saw the highest 30-year fixed interest rates since December 2000, topping out at 7.37% on October 20 and 7.29% on November 4. Thanks to a softening Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) report. December 1 saw a much welcomed 6.25%.

After months of declining to flat week-over-week mortgage purchase application data, November saw four consecutive weeks of increasing demand.

New construction homes are offering 3-2-1 buydowns to help buyers to overcome higher interest rates.

Be the first to comment