home

about

properties

contact

blog

Market Insights

February 6, 2026

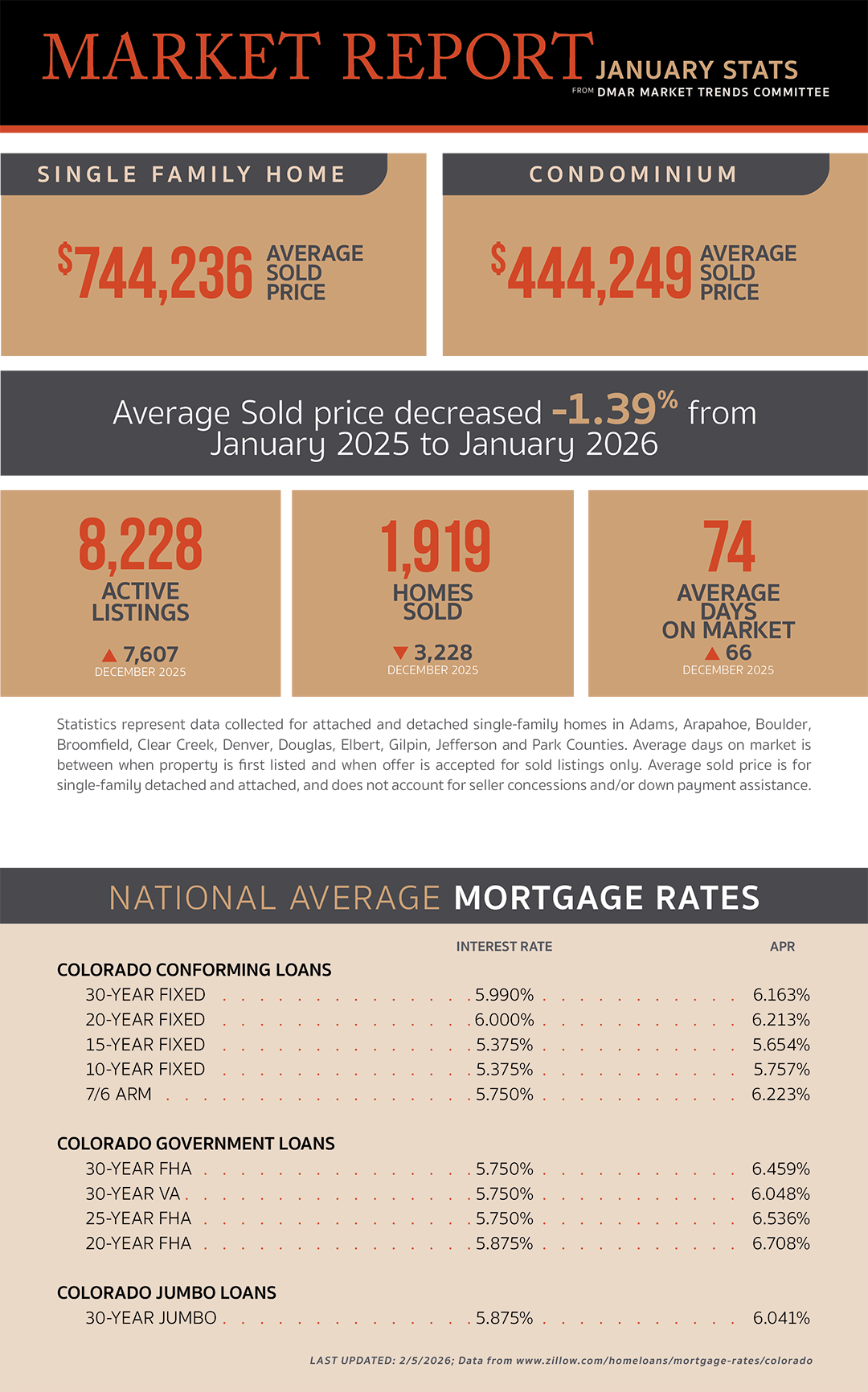

As published in DMAR Market Trends, January 2026

Denver remains an expensive place to live, and buying a home continues to be challenging. Amid ongoing affordability pressures, sellers looking to capitalize on equity gains need to price their homes realistically, using both statistical and qualitative data to support their pricing.

Sellers are adjusting to longer days on market without panic, recognizing that homes simply take more time to sell in today’s environment. Many are also leaning more heavily on their agents’ guidance to properly prepare their homes for the market. First impressions matter more than ever, and cell phone photos and cluttered spaces no longer cut it.

Today’s buyers are prioritizing affordability and practicality. Sellers are best served by preparing their homes thoughtfully, budgeting for inspection-related repairs or improvements and avoiding speculative upgrades unless those investments are truly cost-effective.

This spring, expect bidding wars on well-priced, well-prepared and well-maintained homes in strong locations. While inventory has increased, there remains a shortage of highly desirable homes, those that are reasonably priced, mostly updated and in top-tier neighborhoods.

With nearly $200 million in federal grant funding, the Denver Regional Council of Governments is partnering with the state, businesses, utilities and community groups to cut carbon emissions and update residential heating and cooling home systems with heat pumps.

Redfin anticipates gradual relief for buyers as income growth begins to outpace home price gains nationally. In Denver’s high-cost market, rising local incomes could create pockets of improved affordability.

Denver is no longer mailing property tax bills to all homeowners, shifting statements to online instead. Residents recently received postcards directing them to check their tax statements at Denvergov.org/property. The transition, which began last year, will save the city about $100,000 annually in mailing costs and eliminate the use of nearly 500,000 pieces of paper.

Colorado now ranks fifth nationally for outbound moves, with 55% of moves leaving the state compared to 45% moving in—the highest outbound share since 1990.

To improve air quality and reduce utility costs, Colorado law now requires gas furnaces and water heaters manufactured after January 1, 2026, to meet Ultra Low NOx or ENERGY STAR® standards. Existing systems are unaffected, but future replacements must comply and are expected to cost 40 to 200% more.

According to an analysis by Cinch Home Services, Colorado residential land averaged $942,200 per acre in 2022, up from $343,800 in 2012. This 174% increase over a decade ranks among the fastest gains in the nation.

President Trump has proposed banning large institutional investors from purchasing single-family homes in an effort to improve housing affordability by reducing competition with individual buyers. However, industry experts note that such a ban targets a relatively small share of the market and is unlikely to materially ease prices or expand supply without broader supply-side solutions, making its real-world impact modest at best.

Looking ahead to 2026, buyers may see a rare window of opportunity as new-home prices have converged with, or in some cases fallen below, existing-home prices. Builder price cuts, elevated incentives, modest construction growth and the potential for interest rate easing could improve affordability for newly built homes after several challenging years.

JPMorgan forecasts that nominal home prices may flatten in 2026, while sales activity gradually improves as demand responds to stabilizing interest rates. Slower price growth could help reset seller expectations and boost buyer confidence where affordability improves.

The latest design trend is the addition of dedicated “analog” rooms, which are screen-free spaces designed for board games, music, reading and creative activities.

MORTGAGE NEWS

Last Friday, President Trump effectively nominated Kevin Warsh as the next Federal Reserve chair. Warsh, a former Federal Reserve governor, has previously expressed concerns about Fed policy and has indicated support for lower interest rates. As the nomination process moves forward, he will need to work with a divided Federal Reserve as policymakers continue to assess the appropriate path for rates.

Late-stage mortgage delinquencies reached a three-year high in December 2025, according to data from ICE Mortgage Technology.

RENTAL NEWS

Metro Denver’s apartment market has shifted firmly into renter-friendly territory, with vacancy rates climbing to roughly 7.6% at the end of 2025 (the highest in 16 years). A decade-long supply surge has outpaced demand, driving average rents lower and increasing concessions. Looking ahead, Denver’s apartment construction pipeline is expected to slow sharply in 2026. Mayor Mike Johnston has identified this slowdown as a major concern, as developers face financing challenges and permitting delays, even as recent supply growth has helped ease rental costs.

Be the first to comment