home

about

properties

contact

blog

Market Insights

July 21, 2025

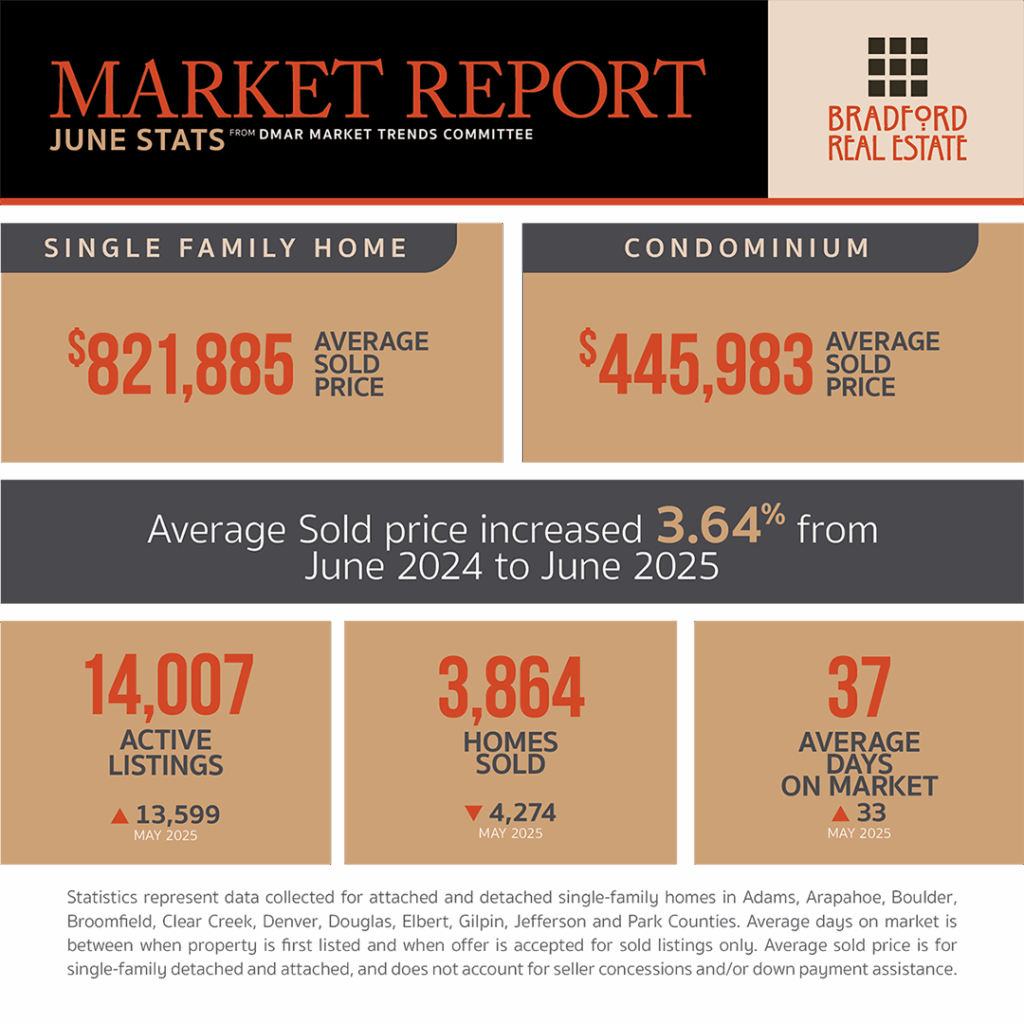

As published in DMAR Market Trends, May 2025

Mortgage applications and showing activity are on the rise, but sales data tells a different story. Contracts are slow, homes are lingering and price reductions are becoming more common. This disconnect signals that the market is in transition. Buyers are waiting, holding out for changes in prices or interest rates. For now, sellers need to price competitively and stay flexible.

Savvy listing agents should advise their sellers that a sale may take weeks or even months. It’s important to set realistic expectations as we head into a slower season, with temperatures and summer vacations distracting many buyers.

Sellers hoping for a quicker sale should plan their pricing strategy, including when and how much to reduce the price. Without a plan, it’s easy to let emotions take over once days on market stretch and showings slow. Waiting “just one more week” to reduce the price can lead to extended days on market and higher carrying costs.

Consumer prices in the Denver-Aurora-Lakewood MSA rose 2.2% year over-year in May 2025, up from 1.9% in March. Core inflation increased 2.7%. The largest annual gains were reported in other goods and ser vices (+14.3%), medical care (+5.6%) and housing (+1.9%).

U.S. Consumer confidence fell 5.5% between May and June, reversing nearly half of May’s gains. The decline was broad-based across the Expectations Index, with weaker views on business conditions, job prospects and income expectations. Fewer consumers planned to buy homes, while car buying and vacation plans remained steady. Tariffs and inflation remained top concerns, though inflation fears eased slightly.

A mostly vacant parking lot at The Shops at Northfield in Central Park may soon be redeveloped with housing, retail and more. The 16-acre parcel may be transformed into a vibrant mixed-use community.

Colorado saw the largest increase in the average escrow payment in the nation, up 31% from last year, primarily due to the rising property taxes and insurance costs.

Metro Denver’s 2025 homeless count showed an 8% overall increase, totaling 10,774 people. However, unsheltered homelessness dropped to a six-year low, thanks to expanded shelter access and housing programs. This shift may help improve neighborhood stability and public perception, even as long-term housing needs persist.

According to a new SmartAsset study, a salary of $105,955 is needed to live comfortably in Colorado. The estimate is based on the 50/30/20 budgeting rule, which allocates 50% of income to necessities, 30% to discretionary spending and 20% to savings or debt repayment.

A recent Zillow report found that home insurance premiums increased 38% nationally since 2019, while median homeowner income rose just 22%. In Denver, premiums rose 43%, while income increased 24%, ranking the city 14th in the study.

Residents along an eight-mile stretch of 1-70 are hopeful that a planned $27 million wall will act as a sound barrier, reduce dust and improve safety from highway traffic.

Although the national median sale price hit a record high of $396,500 in June, it remains 6% below the median list price, reflecting the imbalance between the number of sellers and a smaller pool of buyers.

Builder incentives reached an all-time high, according to the National Association of Home Builders, with 37% of builders cutting prices and offering sales incentives.

Today, more households have pets than children, a shift that is influencing homebuyer decisions. Nearly one in five recent buyers said pet needs were a key factor in choosing their home and neighborhood.

The MBS Highway National Housing Index dropped 8 points in June 2025 to 34, reflecting persistent economic uncertainty that continues to hinder housing activity.

MORTGAGE NEWS

The director of the Federal Housing Finance Authority instructed Freddie Mac and Fannie Mae to draft a proposal exploring the potential inclusion of crypto assets in mortgage underwriting.

Be the first to comment