home

about

properties

contact

blog

Market Insights

September 17, 2024

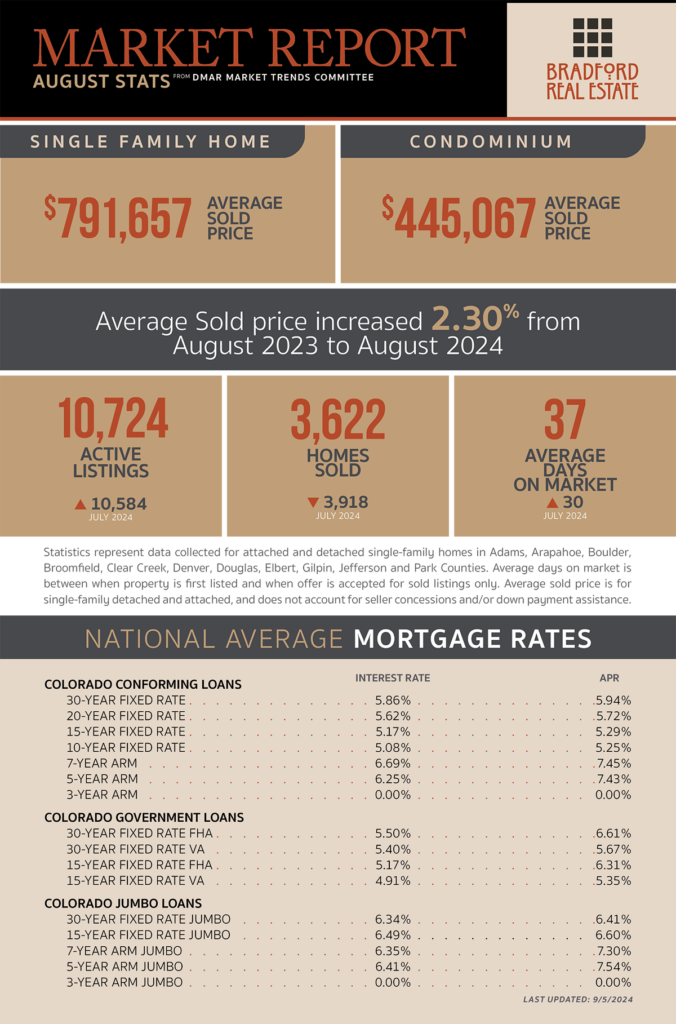

As published in DMAR Market Trends, August 2024

September is traditionally a challenging month to list a home as end-of-summer trips and back-to-school distractions often tend to reduce buyer activity. Sellers who decide to list during this time would be wise to invest in pre-inspections, making necessary repairs and ensuring their property is fully prepared to make a strong impression before marketing.

Many buyers are focusing on flooring, with a preference for consistent updated flooring throughout each level of a home. Homes with multiple mismatched flooring types are often less appealing to potential buyers.

While open houses seemed to make a comeback earlier this summer, August brought a noticeable lull to the open house activity.

Many sellers seem to recognize the current market challenges and understand the importance of offering compensation to a cooperating buyer’s agent. This strategy is key to ensuring good representation on both sides of the transaction to facilitate a smooth sale.

Colorado ranks among the top five most expensive states to live in and is second in the nation for both hail claims and wildfire risk, according to the Rocky Mountain Insurance Information Association (RMIIA).

The slowdown in Colorado home sales has led to an increase in seller concessions. Over half of all statewide transactions this summer included concessions to attract buyers feeling the pressure of interest rates and insurance premiums.

U.S. new-home sales rebounded to their highest level since May 2023, as buyers took advantage of lower mortgage rates and an increase in available listings.

Nearly half of renovating homeowners say they’re tackling outdoor projects to upgrade their homes, prioritizing colorful front doors, exterior accents, outdoor trim, upgraded landscaping, outdoor kitchens and lighting to improve living spaces and boost curb appeal.

Pending sales of starter homes increased by more than 10% year-over-year in July, reaching their highest level since October 2022, signaling that first-time homebuyers are taking advantage of a slower market.

Total home sales are now projected to be lower than previously expected for the rest of this year, with a meaningful recovery not anticipated until further into 2025, according to a new forecast from Fannie Mae’s Economic and Strategic Research group.

MORTGAGE NEWS

The highly anticipated Fed rate cut is approaching with the Federal Open Market Committee (FOMC) meeting scheduled for September 17-18. On September 18, the Fed will release its Summary of Economic Projections, providing insights into the Fed’s outlook on interest rates, inflation, GDP and unemployment.

In August, the 30-year mortgage rate dropped from 6.62% to 6.43% according to Mortgage News Daily. Despite this decline, mortgage purchase applications stagnated, dropping by 1.5% for the month.

Be the first to comment