home

about

properties

contact

blog

Market Insights – July 2024

July 15, 2024

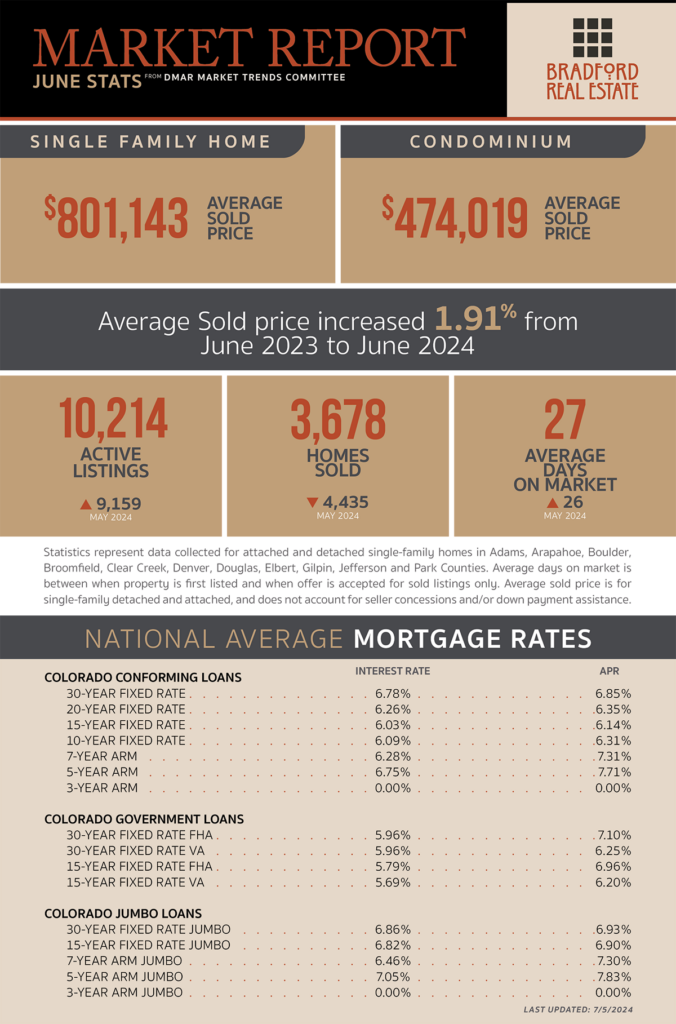

As published in DMAR Market Trends, June 2024

Home sellers are returning to the market but are finding buyers hesitant.

While market dynamics have shifted in recent months with an influx of demand, it remains important to focus on area-specific micro-markets — which can vary significantly in activity — when pricing homes or helping buyers.

With days in MLS ticking up, this is an excellent opportunity for those who weren’t competitive in the previous market to start shopping again.

Buyers are cautious about purchasing at what might be the “top” for a while, while sellers still expect multiple offers on overpriced properties.

The number of contract terminations is rising. Sellers may need to be more cooperative and solutions-oriented during inspection negotiations to keep their closing on track.

Buyers today want less deferred maintenance and more updates. Sellers should make sure their home’s HVAC, roof and water heater are properly maintained and not past their lifespan to sell their home quicker and for more money in today’s market.

Denver ranked 12th in the nation with the highest number of people moving out of the state, up from 18th in 2023. California ranked the highest, with Los Angeles first and the San Francisco area second.

Skyline at Highlands, comprising 533 luxury apartments, recently opened in Denver. To address affordability in the neighborhood, the developer (in cooperation with the Denver Public Schools Foundation) ran a lottery in which 10 eligible teachers won a year of free rent.

Glass blocks are back in vogue as one of the hottest design and architectural trends.

The CoreLogic HIP ForecastTM projects that home prices will increase by 3.7% from March 2024 to March 2025.

Millennials are defying norms by taking charge of solo home purchases and buying with friends and family. According to Bankrate’s new Home-buying Trends Survey, 42% of millennials have purchased a home alone, compared to 34% of Gen Xers and 22% of baby boomers. Additional, 10% of millennials have bought a home with a friend, and 7% have purchased one with a relative other than their domestic partner or spouse.

Last year, 43% of homebuyers used a gift from family or friends to help with down payments.

Construction starts for single- and multi-family homes have plateaued after a steep drop last year, a pattern similar to one that preceded the 2008 housing corrections.

Cracks are showing in the U.S. labor market as initial jobless claims hit a 10-month high. Continued jobless claims reached their highest level since November 2021, and unemployment hit 4% for the first time since January 2023.

MORTGAGE NEWS

The upcoming election is contributing to economic uncertainty, affecting both consumer and corporate confidence. This uncertainty is prompting firms and households to delay significant spending decisions. Note that lower spending leads to softening inflation and lower GDP, which could result in lower mortgage rates and an increase in home sales post-election.

Mortgage purchase applications increased by 11.7% during June, while mortgage rates dropped from 7.17% to 6.97%. If demand returned to the levels of this week in 2019, we would see an 80% jump in mortgage purchase applications.

Be the first to comment