home

about

properties

contact

blog

Market Insights

October 21, 2025

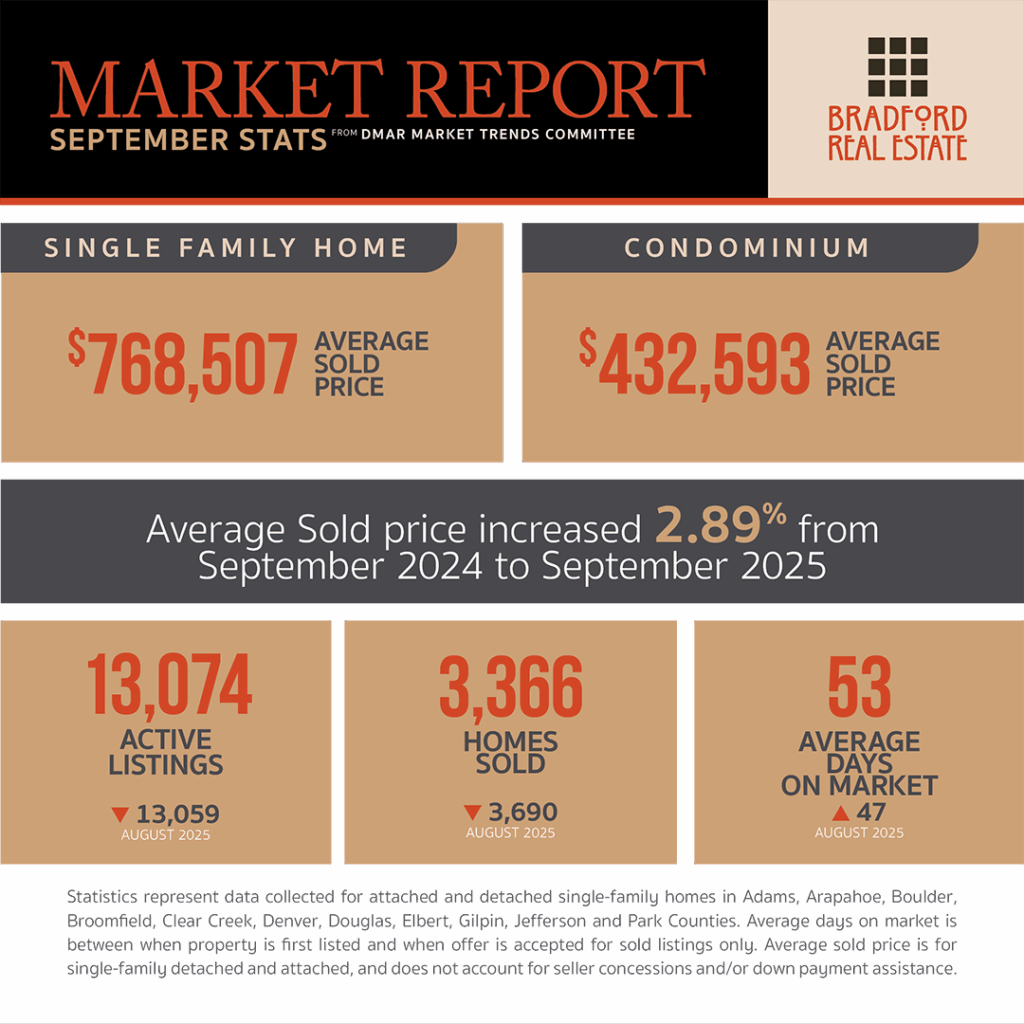

As published in DMAR Market Trends, September 2025

A smart pricing strategy for sellers today is to compare their home against current similar inventory and pending listings, rather than relying on the past six months of sales data, a method that was common until recently.

Inspection waivers are a thing of the past. Savvy sellers are now conducting pre-listing inspections and addressing issues upfront to ensure their homes present well during due diligence and to avoid offering buyer credits for repairs.

It’s important for sellers to have appropriate expectations in this shifting market. With remote work now the norm for many buyers and the market pace slower overall, showings are increasingly taking place during the week instead of primarily on weekends.

Given persistently higher interest rates, requests for rate buydowns have become common. Sellers should anticipate these buyer concessions and factor them into their net sheets before listing.

Nationwide, 40.3% of homes are owned outright with no mortgage, the highest percentage ever recorded. Locally, however, Denver has one of the lowest shares of mortgage-free homeowners at just 27.1%.

The Real Estate Investment Index recently ranked 50 cities for first-time real estate investors. Three Colorado cities made the list: Aurora (31), Colorado Springs (34) and Denver (36).

In August, Miami ranked as the strongest buyer’s market in the country, with 142.8% more sellers than buyers, while Newark, NJ was the strongest seller’s market, with 43% fewer sellers than buyers. Denver ranked as a strong buyer’s market, with 57% more sellers than buyers.

Colorado continues to face a shortage of new housing despite slower net migration. To keep up with demand, the state needs more than 34,000 new homes per year, a shortfall compared to the 106,000 homes estimated as necessary in 2019.

In Globeville, a new library and 170 affordable housing units are coming to 4995 Washington Street, the site of a former used-car lot. The 250,000-square-foot development will include the library on the ground floor along with community-oriented commercial space.

In the Denver Tech Center, a vacant 120,000-square-foot office building on the 4000 block of South Monaco is being converted into 143 affordable apartments. Developer Shea Properties expects one-bedroom units to rent for approximately $1,400 per month, with move-ins scheduled to begin in summer 2026.

Xcel Energy and two telecom companies have reached a settlement in the Marshall Fire trial. Colorado’s largest utility expects to pay around $640 million to plaintiffs, including insurers, Boulder County and residents. The agreement is not yet final and must still be approved by individual plaintiffs.

Construction activity continues to rise, fueling higher home prices. Combined with lingering COVID-era price gains in many markets, affordability remains a significant challenge.

A recent nationwide survey of more than 1,000 homeowners undertaking remodeling projects found that half reported significant stress and “renovation fatigue” due to delays and disruptions. Nearly 40% also went over budget, largely because of unexpectedly high material and labor costs.

Mortgage News

According to the Mortgage Bankers Association, the average contract rate on 30-year fixed mortgages (conforming balance) increased to 6.46% in the week ending September 26, reversing a multi-week downward trend in rates.

In Denver, a Realtor.com report suggests that further rate declines could “unlock” more buyers, since the metro area has one of the highest shares of homes with mortgage debt, second only to Washington, D.C.

Be the first to comment