home

about

properties

contact

blog

Market Insights

June 19, 2025

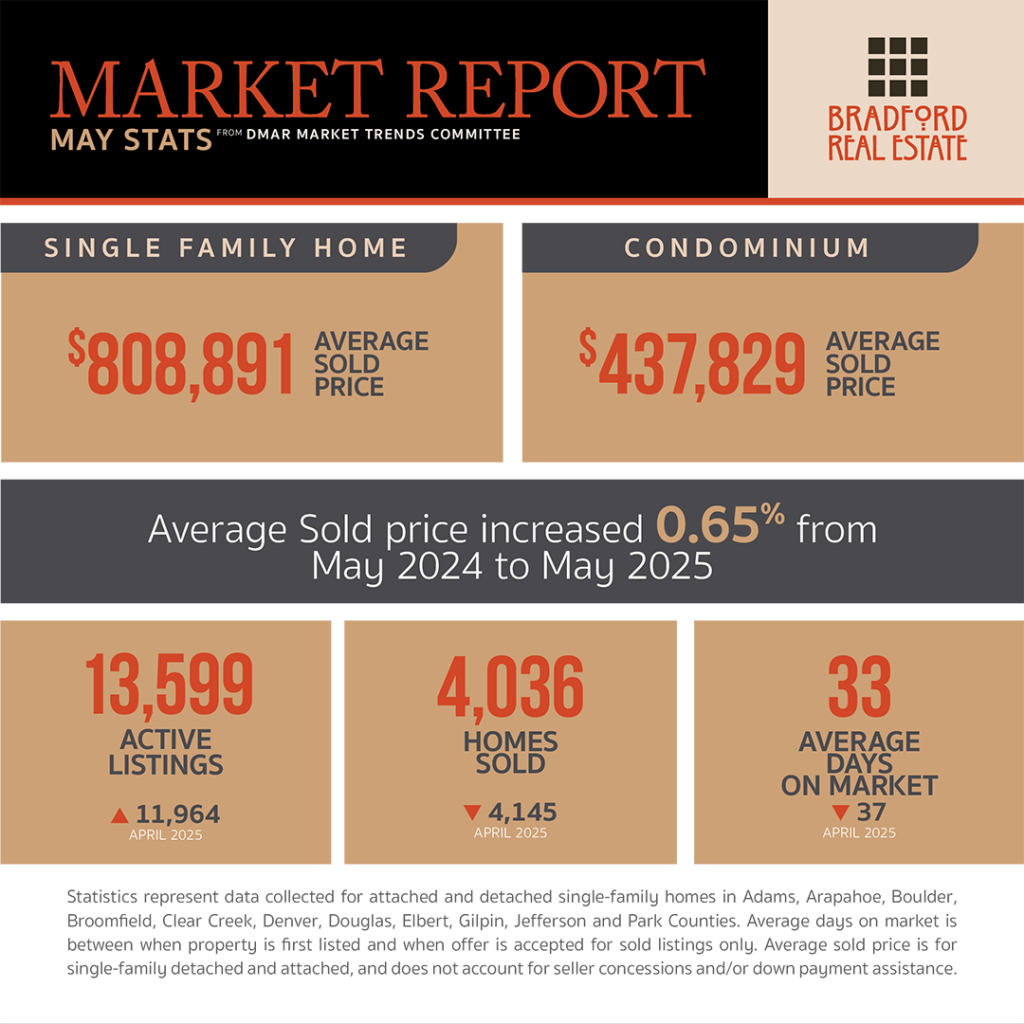

As published in DMAR Market Trends, May 2025

It’s time to acknowledge that in most areas, the market has shifted. We’ve moved from a time when buyers were battling each other to win a single home, to a market where sellers are now competing with their neighbors to sell first. Multiple offers still exist, but results are more tepid. A seller could receive three to five offers that are all around the same list price or asking for concessions. As always, neighborhood, price and condition are key factors.

The market is experiencing an increase in contract terminations driven by buyer hesitation, often due to inspection concerns that are relatively minor. Today’s buyers are more cautious, discerning and deliberate in their decision-making process.

In a recent report, multi-generational homes hit an all-time high in 2024, accounting for 17% of home sales nationally. Thirty-six percent of buyers in the survey cited cost savings as the primary reason for purchasing a multi-generational home

The town of Erie, Colorado, ranked as the 15th fastest-growing city or town in the nation by the U.S. Census between July 2023 and July 2024.

Colorado tied with three other states for the fourth-largest number of homes with price reductions (21%) nationwide last month.

Five years after COVID-19, Denver’s downtown recovery continues to lag behind most other cities, dimming the city’s reputation as a vibrant city and making it harder to attract businesses, tourists, and residents from other areas.

Denver, long-known for its tight housing supply, is now among the top U.S. metro areas for rapidly growing unsold inventory. In March, active listings in Denver rose by 67.3% year-over-year — more than double the national average increase of 28.5% — as new listings outpaced sales. This surge places Denver just behind San Jose and Las Vegas, with only fractional differences in inventory growth.

Denver has one of the best park systems among the biggest cities in the United States, according to the Trust for Public Land, a nonprofit that published its annual ParkScore index on Wednesday. May 21.

The National Association of Home Builders/Wells Fargo Cost of Housing Index measures the share of income needed for mortgage payments. In Q1 2025, a family earning the area median income in the Denver Metro area would need to allocate 45% of their pre-tax earnings to afford a mortgage on a median-priced existing single-family home. For low-income households, those earning less than 50% of the area median, that share jumps to 90%. Nationally, the average household would spend 35% of their income on a mortgage, while low-income families would spend 70%.

To address a shortage of 100,000 housing units, Governor Polis issued an executive order threatening to withhold state grants from local governments that do not comply with new housing laws, such as easing occupancy limits and promoting accessory dwelling units. This move has faced legal challenges from municipalities citing concerns over local control.

Governor Jared Polis vetoed a bill that would have prohibited landlords from using rent-setting algorithms, citing concerns about removing potentially beneficial tools for managing housing. The decision has sparked debate among housing advocates and industry stakeholders

In May, Governor Polis announced the 21 recipients of the funds from Proposition 123, earmarked to help build nearly 1,900 attainable homes and apartments across Colorado.

House Bill 1272, signed by Gov. Polis attempts to correct construction defects by lowering the chances homeowners will sue developers and builders, allowing for more condo and starter home building.

Douglas County is getting a new Mega Sports complex located near Sterling Ranch.Zebulon Sports Complex will be 46 acres of sports courts, fields and ice.

Kaia Residences, a new apartment complex, broke ground in Capitol Hill, paving the way for 295 units, 19 affordable units, 8.500 sq. ft. of retail space with 4.000 sq. ft. for a wellness market and 290 parking spaces.

US News ranked the best places to live in Colorado for 2025-2026. The top cities were: #1 Centennial, #2 Parker and #3 Castle Rock.

April data showed personal income was up 0.8%, the strongest since May 2021, wages were up 4.3%, consumer spending was up 0.2%, retail sales were up 0.1% and the four-week jobless claims average was down 250 jobs. This economy feels like it’s slowing, but the numbers show its resilience.

A 2025 survey found that 84% of homeowners are now prioritizing projects that bring joy over return on investment. Top projects include interior painting, new windows and floors, updated lighting, walk-in closets, sunrooms, hobby spaces, pools and hot tubs, built-in bookcases and home gyms.

Nationwide, homebuyers who purchase newly-built homes are typically saving about half a percentage point on their mortgage from builder incentives, translating to a savings of about $105 per month on a $400,000 home.

Between 2021 and 2023 (the latest year of available data), median property taxes rose nationally by an average of 10.4%. The average homeowner now pays $2,969 a year in property taxes.

MORTGAGE NEWS

Although it may not seem like it, we have now had 17 consecutive weeks of year-over-year increases in mortgage purchase applications.

Mortgage rates moved within 0.20% during the entire month of May, giving buyers a little more stability than in previous months.

Be the first to comment