home

about

properties

contact

blog

Market Insights

April 21, 2025

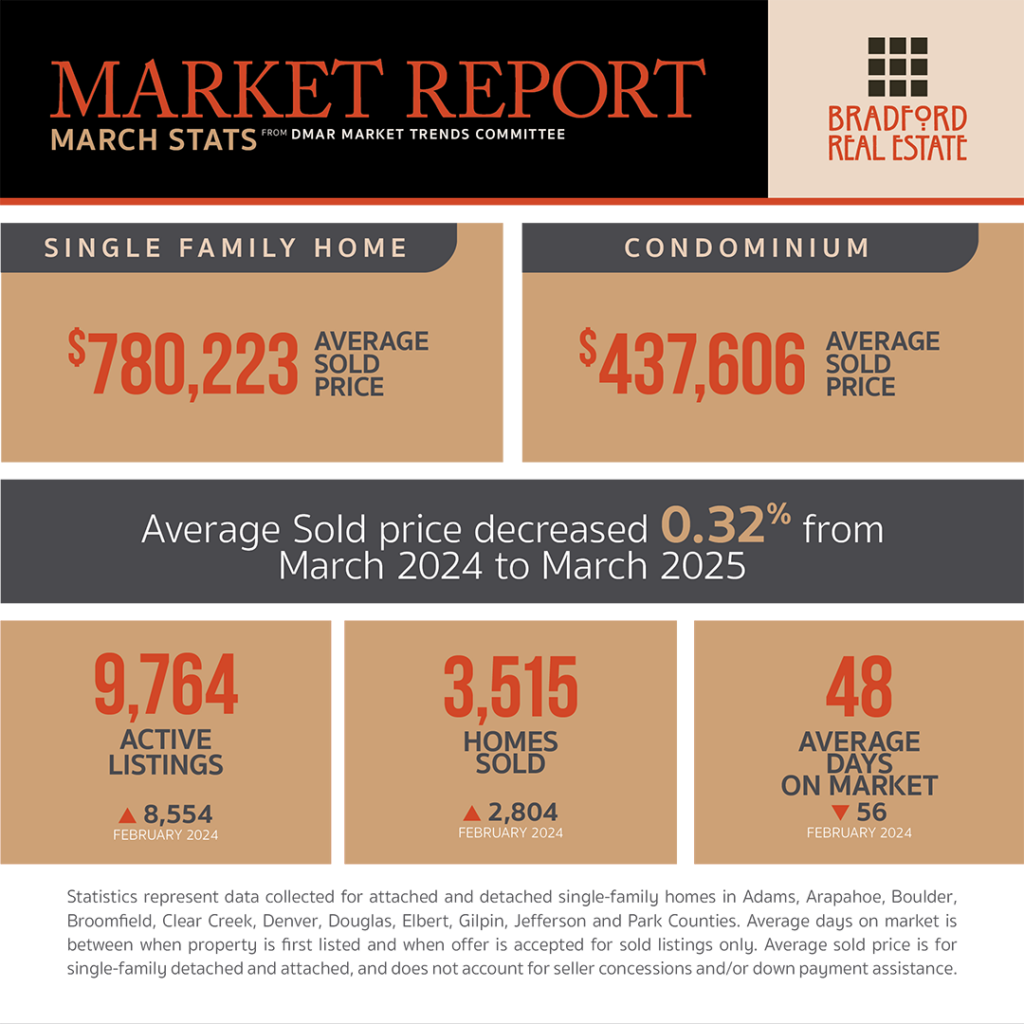

As published in DMAR Market Trends, March 2025

Buyer activity has increased in this spring market. However, seller activity is still outpacing buyers. Homes that have been well-prepared, highlight unique features and offer easy access, including open houses, get noticed and considered by serious buyers.

The week of April 13-19 is officially the best time to sell in 2025, according to Realtor.com’s annual analysis. This week offers the most favorable market conditions for sellers — stronger home prices, peak buyer demand and lower competition from other listings.

Buyers continue to be fickle and wait for the right properties to come along and don’t mind competing for well-priced homes in turnkey condition in desirable areas. Properties within HOAs continue to struggle with barriers to desirability and warrantability.

Two bills are under consideration in this legislative session. HB25-1043, one vote from approval, aims to protect homeowner equity by allowing a nine-month stay before foreclosure auctions giving homeowners time to sell and pay off debts. The second bill, still in its early stages, proposes an alternative dispute resolution process.

Denver has secured a spot among the top 20 cities for AI-related job hiring, with over 250 job openings in January, highlighting the city’s growing role as a hub for AI companies.

Three of Colorado’s cities are in the nation’s top 15 strongest buyer’s market due to inventory growth with Colorado Springs at fifth, Boulder at tenth and Denver at thirteenth nationwide.

RTD is looking into using unused Park-n-Ride lots as affordable housing with one sale already completed with a real estate developer.

A report by Zillow showed that sellers of off-market properties sold for significantly less money, and in communities of color, that amount was even more significant.

In March, builder confidence in the market for newly built single-family homes nationwide dropped to 39, a decline of three points from February and the lowest level in seven months.

Government-Sponsored Enterprises were ordered to terminate all Special Purpose Credit Programs. While this change removes some homebuyer grants, it effectively pushes down payment assistance to the state and local levels.

February 2025 active new build housing inventory in Denver is 28% higher than February 2019. Homebuilder unsold inventory hit a 15-year high, opening more opportunities for buyers in the new build space. In fact, Lennar is offering buyer incentives on its typical sale totaling 13% of the home’s sale price, up from just 1.5% in Q2 2022.

The new tariffs are predicted to raise the cost of building a new home between $7,500 and $10,000 on average per home, largely due to the increased cost of lumber from Canada.

The University of Michigan’s consumer sentiment index declined by 10.5% to 57.9 in March, following a 10% decline in February. Year-over-year, this represents a 27.1% decline. The drop is the largest month-over-month increase in long-term inflation expectations recorded since 1993.

MORTGAGE NEWS

Stock market weakness on sticky inflation and quarter-end reports gave bonds a quick dip, dropping the 10-year 12.7 basis points on Friday. Rates ended the month at 6.76%.

The Federal Reserve lowered 2025 GDP growth expectations to 1.7%, raised core inflation projections to 2.8% and increased the year-end unemployment forecast to 4.4%. Despite these adjustments, the Federal Reserve maintained its outlook for two rate cuts in 2025 and two in 2026.

In a letter dated March 26, HUD announced that, starting May 25, 2025, FHA-insured loans will no longer be available for non-permanent U.S. residents. However, non-permanent status will still be permitted for conventional loans, though further changes are expected.

Be the first to comment