home

about

properties

contact

blog

Market Insights

November 19, 2024

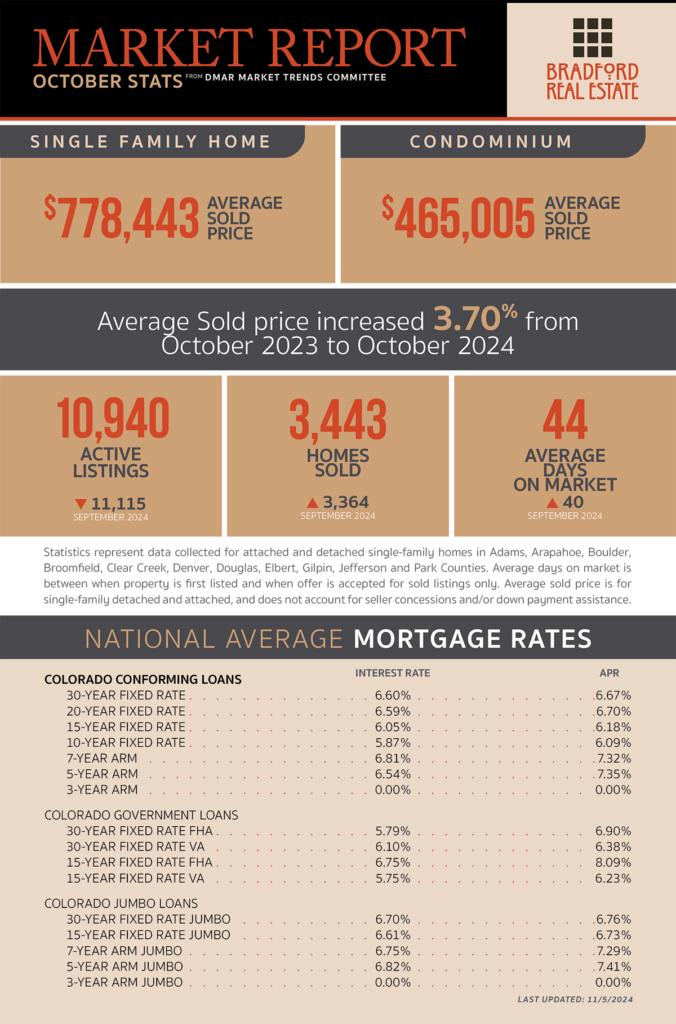

As published in DMAR Market Trends, October 2024

As Thanksgiving and Christmas approach, buyer traffic and activity typically decline. This seasonal slowdown often leads buyers to perceive listings that stay on the market over the holiday season as highly motivated sellers, leading them to expect better deals.

Sellers planning a holiday listing should capture listing photos now to take advantage of neutral settings and favorable weather before holiday decorations go up.

While it’s not officially a buyer’s market, it certainly feels like one. Perhaps a new term is needed: “buyer opportunity market” — reflecting how a balanced market feels after a decade of being a strong seller’s market.

The seasonal slowdown, coupled with election distractions, has put buyers in the driver’s seat, with sellers more willing to offer concessions on price, repairs and closing costs.

Cities are increasingly vigilant about renovation projects that lack proper permits and are red-flagging non-compliant work.

A Minneapolis-based company has purchased over 129 acres near Denver International Airport in Aurora, intending to develop into a new industrial complex.

High-altitude luxury homes in Colorado are increasingly featuring home-oxygenation systems.

Denver City Council approved a rezoning plan around Ball Arena to support a residential redevelopment project that will create a neighborhood with parks, paths, retail and approximately 6,000 housing units.

Denver’s living costs are approximately 27% above the national average.

Denver will transform the landscape around the City and County Building, replacing aging irrigation with more efficient systems and switching traditional bluegrass to native grasses and wildflowers. The project to be completed next fall, is expected to reduce annual water usage from 1.2 million to 670,000 gallons.

Zillow will soon show climate risk data on its listings.

A Redfin survey found that 23% of first-time buyers are waiting until after the election to purchase, citing reasons like economic uncertainty, potential Fed rate cuts and candidate policy impacts.

According to Zillow’s 2024 Consumer Housing Trends Report, the largest share of buyers lives in the South (43%), followed by the Midwest (23%), the West (21%) and the Northeast (13%).

In September, existing home sales declined in three of four major U.S. regions, though the West saw a slight increase. Year-over-year, sales fell in three regions but increased in the West.

The economy showed robust growth, with consumer spending up by 3.7% and GPD growth at 2.8%. With 254,000 jobs added in September, low inflation and rising consumer confidence, some experts suggest a “soft landing” has been achieved.

The National Association of Realtors® predicts a 3.8% rise in existing home prices by the end of 2024, with a 2% year-over-year increase by the end of 2025.

Earth tones like terracotta rust, ochre and deep greens are predicted to make a big comeback in 2025.

MORTGAGE NEWS

Since the Fed cut the rate by 0.50% on September 18, mortgage rates have been climbing, starting at 6.15% and reaching 7.02% by the end of October.

For the third consecutive year, mortgage rates have spiked just before Halloween.

More than 84% of outstanding mortgages are below 6%, with over 56% below 4%, according to research by realtor.com®.

Be the first to comment