home

about

properties

contact

blog

Market Insights

October 21, 2024

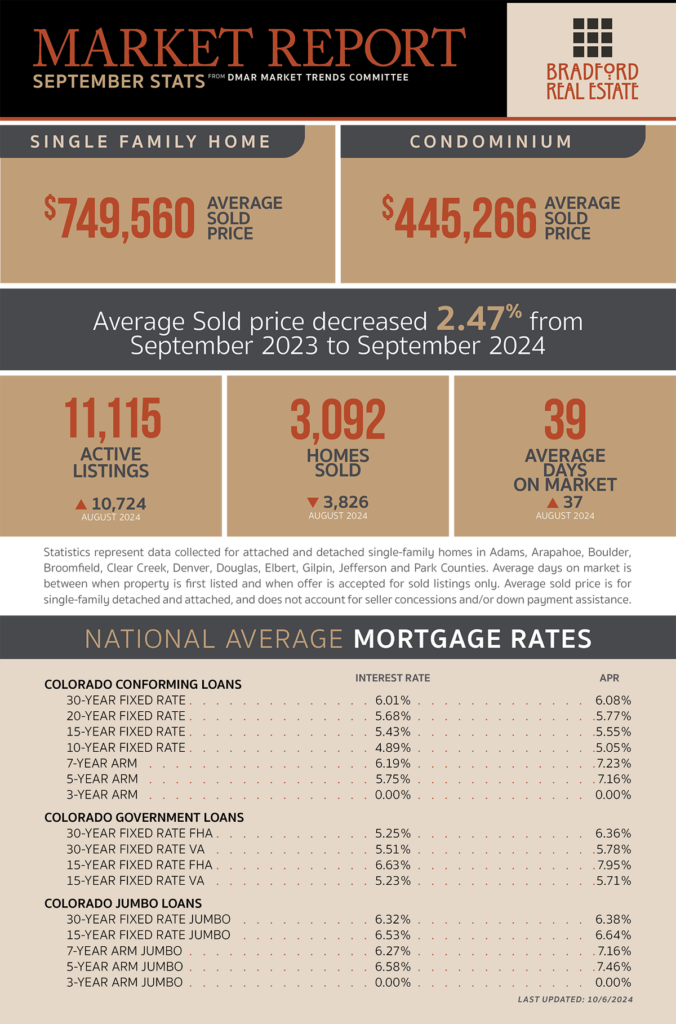

As published in DMAR Market Trends, September 2024

Sellers who were previously on the fence are now considering listing their homes.

Homeowners planning to list in 2025 should consider taking exterior photos now, while landscapes and lawns are free of snow.

There’s a growing trend of parents purchasing homes in Colorado to be closer to their children and grandchildren. Buying a second or vacation home offers a convenient way to encourage longer and more frequent family visits while maintaining the freedom and flexibility that comes from avoiding hotels and rigid travel schedules.

Colorado now shares the second-highest home insurance premiums with Texas, behind only Florida and Louisiana.

While only 2.5% of U.S. homes changed hands this year — the lowest rate in decades — Denver ranks eighth nationally with 296 homes per 1,000.

Amazon purchased land near Denver International Airport for $91 million, signaling plans for expansion and potentially bringing more jobs to the area.

Denver’s low-income families benefit from new income-based housing options with the opening of the Mosaic Community Campus. The development, part of the former Johnson & Wales Denver campus, includes four buildings with 154 apartments.

This November, Denver voters will weigh in on two key ballot measures: Ballot Issue 2Q, which would raise sales taxes by 0.34 percentage points to fund Denver Health and Ballot Issue 2R, which would increase the tax by 0.5 percentage points to support affordable housing initiatives. If both pass, sales tax on a $100 purchase would increase by 84 cents.

Homes sellers who used a real estate agent earned an average of $79,000 more than those who sold without one.

The best week to buy a home is September 29 to October 5, followed by the two weeks afterward. This period offers a favorable balance of market conditions for buyers.

In August, nearly half of all listings nationwide stayed on the market for over 60 days, the highest since 2019.

Baby boomers collectively own more than $19 trillion in real estate, with only $2.66 trillion in debt — a low loan-to-value ratio of 14%.

The U.S. housing turnover rate hit its lowest point in 30 years, due to the lingering “lock-in” effect.

Wallpaper is making a strong comeback for 2024, as consumers seek to add more personality to their homes.

MORTGAGE NEWS

The Bureau of Economic Analysis (BEA) recently revised its data for 2022-2024, adjusting disposable income upward by 3%, personal spending by 0.3% and the savings rate from 2.9 to 4.8%. These revisions could explain the resilience of consumer spending.

On September 18, the Fed cut rates by 50 basis points, the first 50 basis point cut since 2008 and the first in four years. Following this, the 10-year treasury yield rose by 0.15%, and the 30-year mortgage rate increased to 6.25%

Mortgage purchase applications have risen for five consecutive weeks, boosting th3e MBA Purchase Application Index by 12% in September.

Be the first to comment