home

about

properties

contact

blog

Market Insights

August 22, 2024

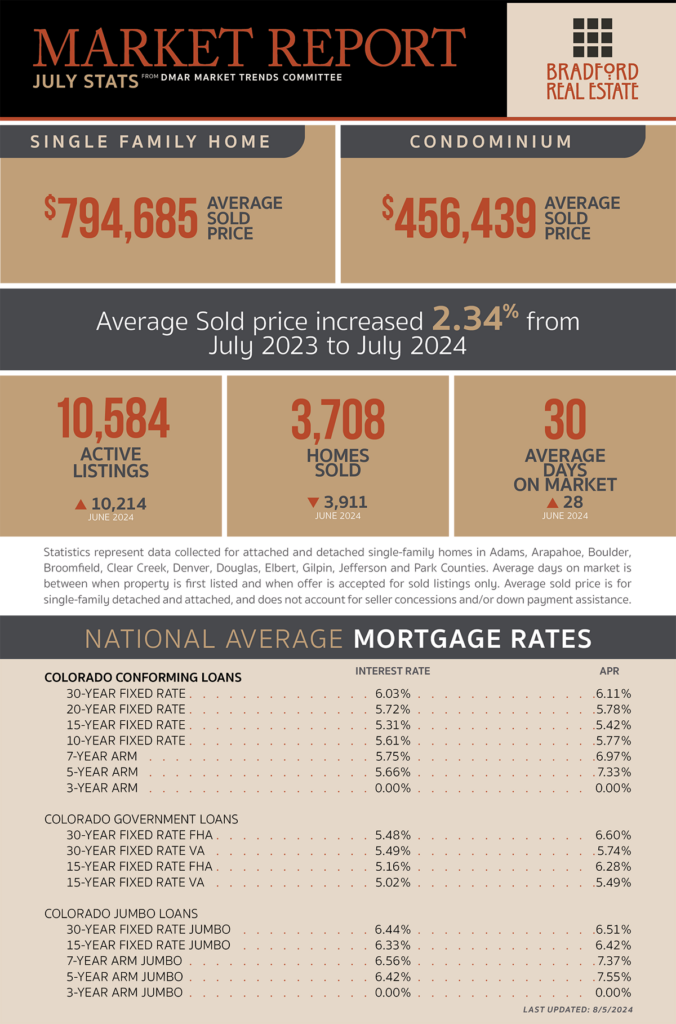

As published in DMAR Market Trends, July 2024

The widely-held belief that a rate cut is coming in September is affecting both sellers and buyers. Buyers are waiting on the sidelines until the cut, while sellers are holding off on adjusting prices, anticipating the market will “improve” once rates drop.

Buyers are becoming increasingly practical and discerning, noticing and valuing improvements and upgrades related to energy, water and space efficiency. In July, many buyers found their dream homes and negotiated fair purchase contracts as sellers started to feel the pressure of increased days in MLS.

Denver’s administration announced that the city’s planning department has reduced permitting review times for residential construction projects by 33% compared to 2023.

Aspen, Colorado had five of the top 10 most expensive home sales nationally in the second quarter, including the most expensive sale at $77 million.

As the presidential election nears, anticipation of its impact on the housing market grows. Historically, home sales have increased after nine of the past 11 elections, mortgage interest rates have decreased leading up to eight out of 11 elections and home prices have increased after seven of the past eight elections.

International buyers pulled back from the U.S. real estate market, with existing home purchases falling 36% between April 2023 and March 2024, the lowest level of international investment since the National Association of Realtors® began tracking it in 2009.

Per a recent John Burns survey of architectural designers, new construction homes are getting smaller in an effort to cut costs, achieved by removing hallways and interior walls.

House Bill 1337, signed in June, creates new requirements for HOAs to file foreclosure. This bill limits the amount associations can charge in attorney fees and gives homeowners a second chance in the event their home is foreclosed upon by an HOA.

Some cities and states offer incentive programs to attract remote workers to relocate. These relocation programs provide a variety of perks, including free golf, steak dinners, teeth whitening packages and even cash incentives.

Buyers terminated deals at a high rate in June, with 15% of home purchase contracts terminating nationally.

MORTGAGE NEWS

Nowhere is the gap between the average mortgage rate borrowers hold and the market rate wider than in Colorado, which could create a significant disincentive to sell. The mortgage rate lock-in gap, also known as the “golden handcuffs,” is 3.45 points in Colorado, the largest of any state.

Mortgage purchase application data continues to lag near levels last seen in 1995, dropping every week during July.

Mortgage rates experienced two of their largest drops in July based on expectation, rather than actual data. The first drop occurred after weaker-than-expected CPI inflation data suggested a possible September rate cut. The second drop followed Powell’s comments on July 31 as to the continued expectation of a September rate cut should the data support it.

Per Mortgage News Daily, the 30-year mortgage started July at 7.14% and ended the month at 6.70%.

Be the first to comment