home

about

properties

contact

blog

Market Insights

June 18, 2024

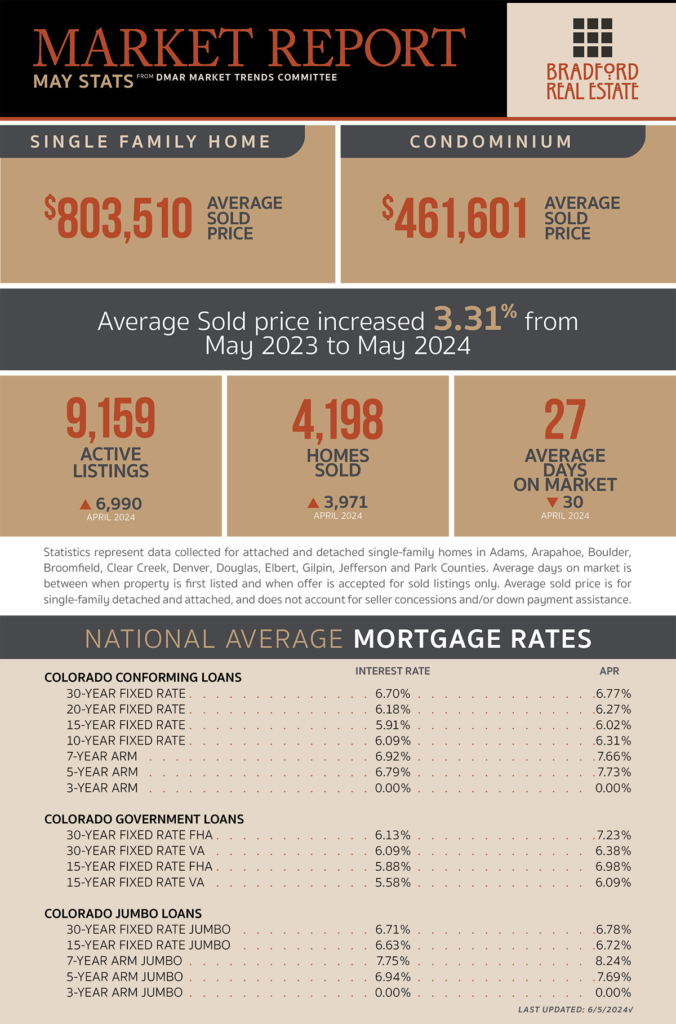

As published in DMAR Market Trends, May 2024

Denver’s real estate market is normalizing but continues to face persistent affordability challenges. This presents opportunities for serious buyers and sellers to negotiate favorable deals in the second half of the year.

Governor Polis approved a bipartisan bill that will cut property taxes saving the average homeowner $500 and capping future tax increases at 5.5%.

Mayor Mike Johnston announced a plan to raise $500 million in public funds to revitalize downtown Denver over the next 10 years.

Overall office vacancy rate in downtown Denver rose to 32% in the first three months of 2024, the highest in decades. However, offices around Union Station and LoDo are faring better, with vacancy rates in the single digits.

Upton Residences, with 461 condos, will be Denver’s second-largest condo project once completed, following the 42-story, 496-unit Spire building that hit the market in late 2009.

Consumer confidence in the U.S. rose in May after three straights months of declines, though Americans are still anxious about inflation and interest rates.

Expectations of a recession in the next year rose again in May but remain below their peak in May of 2023.

Plans to purchase a home remain at their lowest level since August 2012. Sales of existing homes slumped in April due to high mortgage rates and rising prices.

National home sale prices have been rising by about half a percent per month for the last six months, stabilizing price growth back to pre-pandemic levels.

Colorado homeowners report 30 to 130% insurance premium increases, with some being informed that their policies won’t be renewed.

Rising homeowner’s insurance costs, not calculated in inflation numbers, contribute to the perception that inflation figures are inaccurate.

Condo owners face higher dues and special assessments as HOA insurance premiums skyrocket.

April retail sales were flat month-over-month and year-over-year, continuing a trend of mildly slowing sales. After a 15% jump due to Covid, retail sales remained strong through January 2023 but have weakened slightly as spending on post-Covid services rises.

The National Association of Home Builders housing market index fell to 45 in May, down from 51, as higher mortgage rates and persistent inflation impacted all three components of the index (current single-family sales, sales expectations for the next six months and prospective buyer traffic).

The “Western Gothic” aesthetic, featuring dark color palettes with vintage Western and American motifs, is emerging as a top design trend for 2024.

MORTGAGE NEWS

Homeowners who bought one to two years ago hoping for lower rates are feeling the pinch. U.S. delinquency rates were flat at 2.8% from February to March, deviating from the usual seasonal decline. This trend comes as household budgets remain strained by high inflation.

The Veterans Administration announced a target moratorium on foreclosures for Veterans with VA-guaranteed loans through December 31, 2024.

Denver homeowners have an average of $250,000 tappable equity (leaving 20% equity in the home).

The average mortgage rate for Denver homeowners is 3.9%.

As ADUs gain popularity, a new loan program allows for a HELOC based on future value, enabling homeowners to build an ADU without refinancing their low first mortgage interest rate.

According to Bloomberg, 1.7 million adjustable-rate mortgages are about to reset for people who bought around 2019.

Be the first to comment