home

about

properties

contact

blog

Denver Market Insights

May 20, 2024

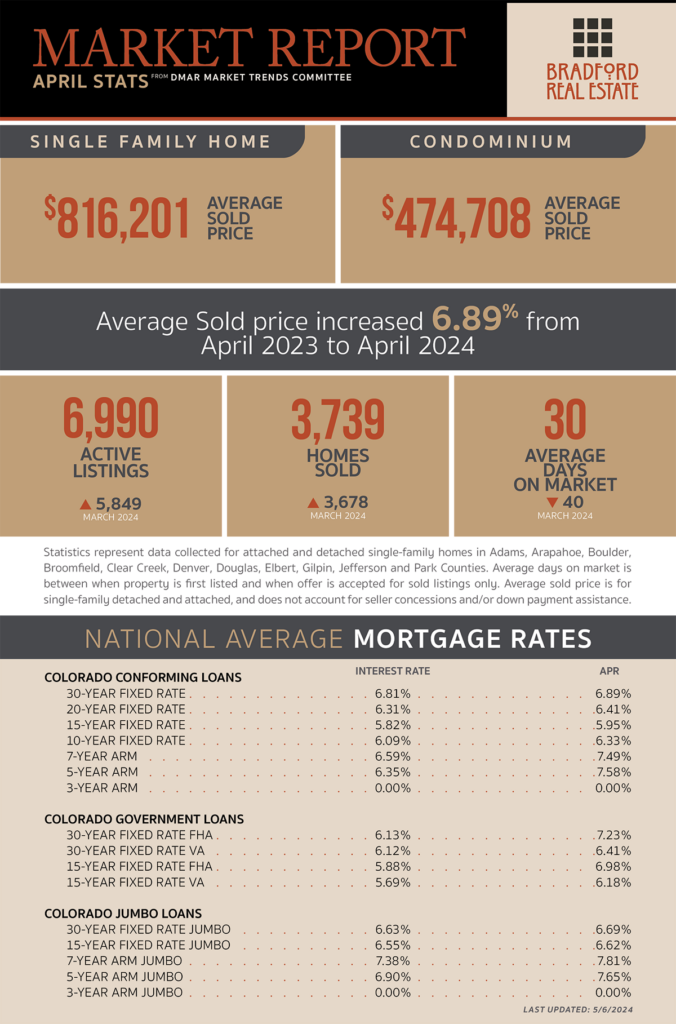

As published in DMAR Market Trends, April 2024

Move-in ready homes priced correctly are selling notably faster and attracting multiple offers, while homes that are not turnkey are struggling to find buyers.

The Denver Metro area ranks as the hottest housing market in the country for a second year in a row, according to a recent analysis from U.S. News & World Report. The report notes that the Denver Metro area “retains a mix of strengths including low unemployment, few mortgage delinquencies, low rental vacancy rates for investors and a positive ratio of building permits to job growth.”

Between devasting hailstorms and catastrophic wildfires, homeowners are getting pummeled by rising property insurance rates. Colorado has the sixth-highest average premiums for a standard homeowner’s policy and some insurers aren’t renewing policies or writing new ones in certain areas.

Vacant land scams are on the rise in Douglas County. These scams can affect single-family homes and condos but are more persistent on vacant, raw or undeveloped land. Often the properties targeted do not have an active mortgage.

State and federal lawmakers are introducing a large number of bills to prevent institutional investors from purchasing residential homes or forcing them to sell in an effort to combat low inventory and high prices.

Nearly one in four renters who have lived in their home for a year or more seriously considered buying when looking for a home to rent with 76% citing affordability for purchasing a home as the main inhibitor.

The share of U.S. home investors recently hit a new high, eclipsing the previous all-time high of 28% back in February 2022. Investor share rising above 30% in 2024 has become a distinct possibility.

MORTGAGE NEWS

Temporary buydowns are filling a gap for high rates. While the 3-2-1 buydown can be expensive, some lenders are paying for a 1-0 buydown for their clients.

At May’s Fed meeting, Fed Chair Powell refrained from expressing the level of concern about inflation that recent data warrants. While he acknowledged it would take longer, he did indicate that the next move is a cut, not a hike.

The market’s implied probability of no rate hikes in 2024 has surged to 20%, up from zero only one month ago.

Be the first to comment