home

about

properties

contact

blog

Market Insights

March 22, 2024

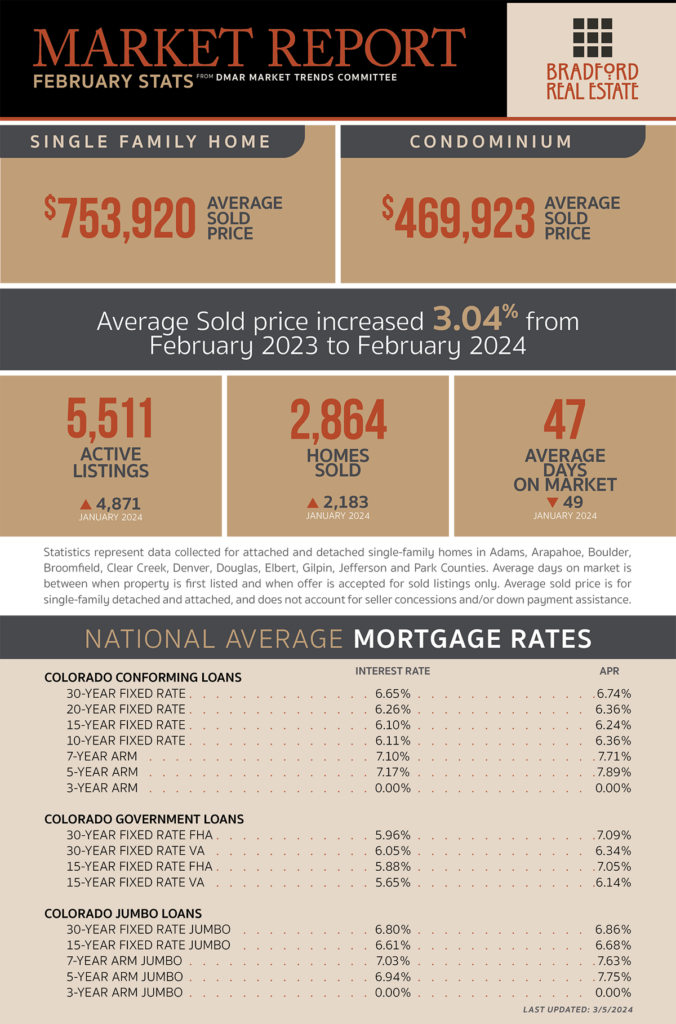

As published in DMAR Market Trends, March 2024

Spring has sprung and the market frenzy is back, particularly for homes priced in the sweet spot, often attracting multiple offers within days of being listed.

The condo market has shifted to a buyer’s market, driven by escalating HOA fees due to the insurance costs and elevated mortgage interest rates. Currently, there are nearly 1,000 condos priced under $500K for sale.

According to the U.S. Census Bureau, Colorado witnessed a significant 7% decline in the homeownership rate last year, the steepest drop among all states.

Golden Triangle continues to be a hotspot for development, with multiple projects in various stages of development underway. Notably, there are five new projects on Bannock Street alone.

A recent study by Point2 Homes ranked Aurora ninth in a top 10 list of cities offering Gen Z buyers the highest chance of homeownership.

Colorado’s economy ranked as the 13th most competitive in the nation in 2023, experiencing a peak in 2017 and a subsequent decline in 2021.

Colorado secured the top spot nationally for housing instability among people 65 and older. With the state’s aging population projected to reach 1.3 million by 2035, seniors on fixed incomes are increasingly challenged by the inhospitable housing market.

Sticker shock coming! County treasurers began mailing tax bills around the first of February that reflect the 42% average increase in Colorado property values between January 1, 2021 and June 30, 2022.

House Bill 24-1152 proposed granting homeowners the right to construct an Accessory Dwelling Unit (ADU) on their property, with eligibility extending to cities within five specified metro areas and a population of at least 1,000. Additionally, it introduces ADU fee reductions and an encouragement grant program.

The Temporary Rental Assistance Grant in Colorado allocated $30 million to aid renters at risk of eviction due to falling behind on payments.

January existing home sales rose 3.1% month-over-month to a seasonally adjusted annual rate of four million, the highest level since August 2023.

New listings of U.S. homes for sale rose 13% year-over-year during the four weeks ending February 25, marking the most substantial increase in nearly three years.

MORTGAGE NEWS

February’s Mortgage Purchase Applications dropped 17% as rates jumped from 6.67 to 7.13%, remaining at elevated levels.

The Core Personal Consumption Expenditures Index (PCE), the Fed’s preferred inflation measure rose by 0.4% from the previous month, pushing the three and six-month average inflation back above 2% for the second consecutive month.

Personal income was surprisingly strong, rising 1% from last month, while spending decreased 0.1% While some potential homebuyers feel financially burdened with job instability and rising prices, others benefit from a buoyant stock market and the resurgence of the crypto market.

Investors acquired 26% of the lowest-priced homes in the U.S. in Q4, marketing the largest share in history.

Be the first to comment