home

about

properties

contact

blog

Market Insights

February 20, 2024

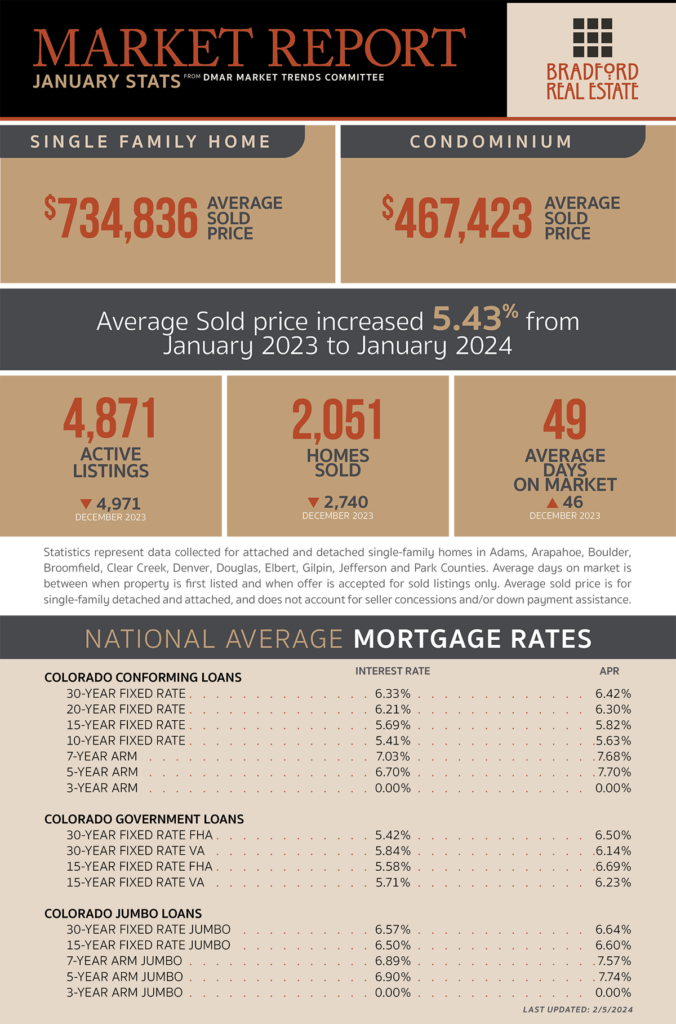

As published in DMAR Market Trends, February 2024

Homebuyers on a $3,000 monthly budget gained nearly $40,000 in purchasing power after mortgage rates dropped to 6.7% from a high of 7.8% in October.

Buyers are back in the market but aren’t necessarily ready to get off the fence as many still have sticker shock over prices and want a move-in ready home.

Buyer activity in the Denver Metro area for a single-family homes under $600,000 picked up drastically in mid-January. Homes listed over the holidays, which saw little to no attention, experienced a sudden pick-up in showings and many new listings received multiple offers.

There is a shortage of single-family, detached, “ranch” floor plan homes priced under $800,000 in Douglas County. Well-maintained homes that match these criteria are selling quickly, with multiple offers. As the population ages in Douglas County expect to see this market get even more competitive.

Enrollment in Colorado public schools in 2023 hit its lowest level since 2013, falling by just under 1% from 2022 pupil counts. At the same time, enrollment in online education programs and homeschooling options increased by 3.4 and 8.4%, respectively. Drivers of the enrollment drop throughout the state includer fewer babies being born and fewer people moving into Colorado.

As Denver continues Mayor Mike Johnston’s House1000 homelessness plan, the city plans to build more micro-communities, acquire more hotels and close more encampments, all while focusing on getting people into permanent housing.

Colorado has opened the Property Tax Deferral Program to the general public so that homeowners who experienced an increase in property taxes of more than 4% over the last two years on their primary home may defer some or all of the annual payment up to $10,000.

In addition to increasing property tax bills, Xcel is planning to raise rates to help offset improvements for both gas distribution and the electric grid. If the Colorado Public Utilities Commission grants the request, a typical resident’s bill will increase by 7.4%.

Consumer confidence in the economy surged 29% since November, the largest two-month increase in over 30 years.

As a result of high prices and low inventory, national home sales dropped to their lowest level since 1995 with 4.09 million homes sold, down 19% from the year before. This reduction follows an 18% drop in home sales from 2021 to 2022.

MORTGAGE NEWS

Mortgage purchase application data has surged, up 24% in January. While still historically low, this welcomed pickup in homebuyer demand has increased 39% from October’s bottom.

The real economic growth rate (GDP) in the 50’s and 60’s averaged above 4%, in the 70’s and 80’s it dropped to 3%. In the last 10 years, the average rate has been below 2%, 2023 defied a recession with an unexpectedly strong 2.5% real GDP growth rate!

Be the first to comment