home

about

properties

contact

blog

Market Insights

January 19, 2024

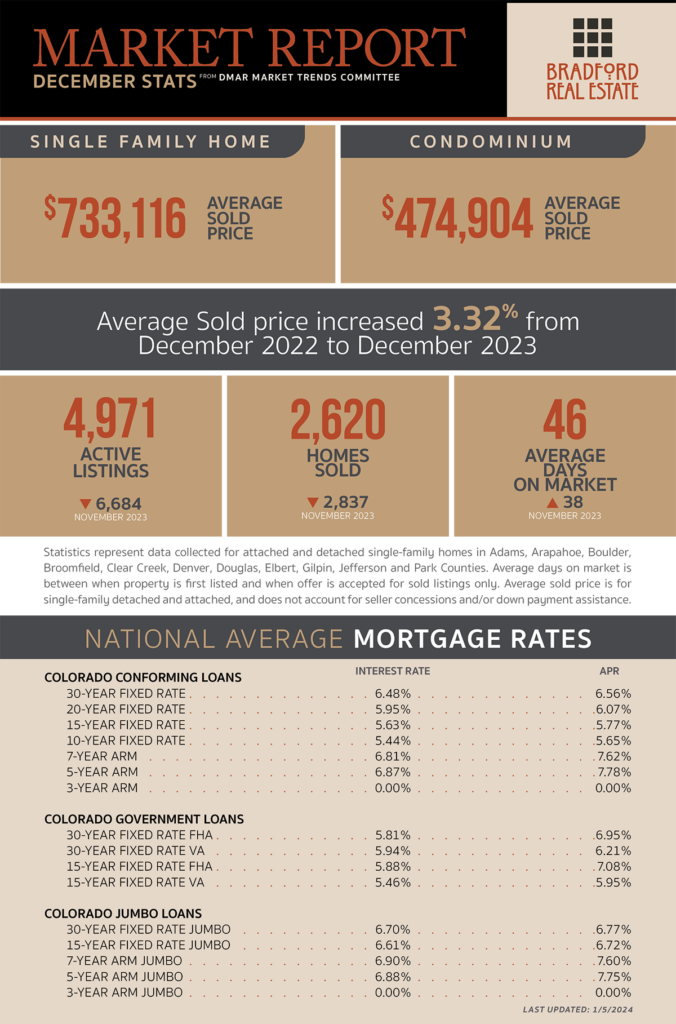

As published in DMAR Market Trends, January 2024

Amidst a slowdown in buyer activity, longer days on the market and more back-on-market listings, some sellers now require higher earnest money deposits.

Real estate agents are reporting a slight uptick in buyers expressing interest in purchasing a property at the onset of 2024, likely due to the dip in mortgage rates and the Federal Reserve’s projection of three rate cuts this year.

Rapid appreciation in property values across Colorado has propelled school districts and local governments towards a projected 25% jump in property tax rolls, even after a $434 million tax cut was approved earlier this year.

To address the housing affordability challenge for educators, some school districts are exploring building tiny homes on their land.

A majority of Colorado voters say homeownership is only going to become less attainable, voicing concerns about the cost of living and the state’s broader affordability.

The Denver Housing Authority completed the renovation of a former medical office building at 655 Broadway into an affordable apartment complex. The nine-story building houses 96 affordable units for seniors and disabled individuals.

Despite tax cuts, home values are still expected to rise 28% this fiscal year, impacting tax bills due in 2024.

Nationwide, existing home sales rose by 0.8% in November, marking the first increase in five months.

Interior design trends for 2024 highlight a shift from black houses, brass fixtures, sharp angles and white oak floors and finishes to more earth-toned homes, silver fixtures, curved architecture and rich, darker wood tones.

Peach Fuzz is Pantone’s Color of the Year for 2024.

A recent survey revealed that one in five homeowners with plans to move had considered renting their homes in 2023; however, financial constraints and manageability realities led 64% of them to ultimately decide against becoming landlords.

Heat pumps are now beating out fossil-fuel-powered gas furnaces in installations and are a strong selling point for sustainability-conscious buyers.

More than a third of non-agent sellers (for-sale-by-owners or owners who sold to an iBuyer) said the selling process was more difficult than they expected, admitting that they struggled to understand their purchase contract, made legal mistakes and were distrusted by buyers in the marketplace.

Conditions for housing are expected to improve as interest rates decline, unlocking inventory, fostering moderate home price appreciation and facilitating smoother transactions.

MORTGAGE NEWS

2023 witnessed mortgage rate volatility, introducing uncertainty among buyers. While the 30-year mortgage rate began and ended the year at 6.6%, rates got as low as 5.99% and as high as 8%.

The market believes the Fed will start cutting rates as soon as March, since inflation is expected to drop for both January and February based on 2023’s 0.5% and 0.4% month-over-month numbers getting replaced by 0.1 to 0.2% However, geopolitical events creating additional chain restrictions could alter this trajectory.

While an assumption purchase can assist a buyer in securing a low-interest mortgage, servicers such as PennyMac are severely backlogged, causing transactions to extend 90 days or more.

For housing to become attainable, Americans either need mortgage rates to fall below 5.5%, wages to increase or a combination of these factors.

Be the first to comment