home

about

properties

contact

blog

Market Insights

September 27, 2023

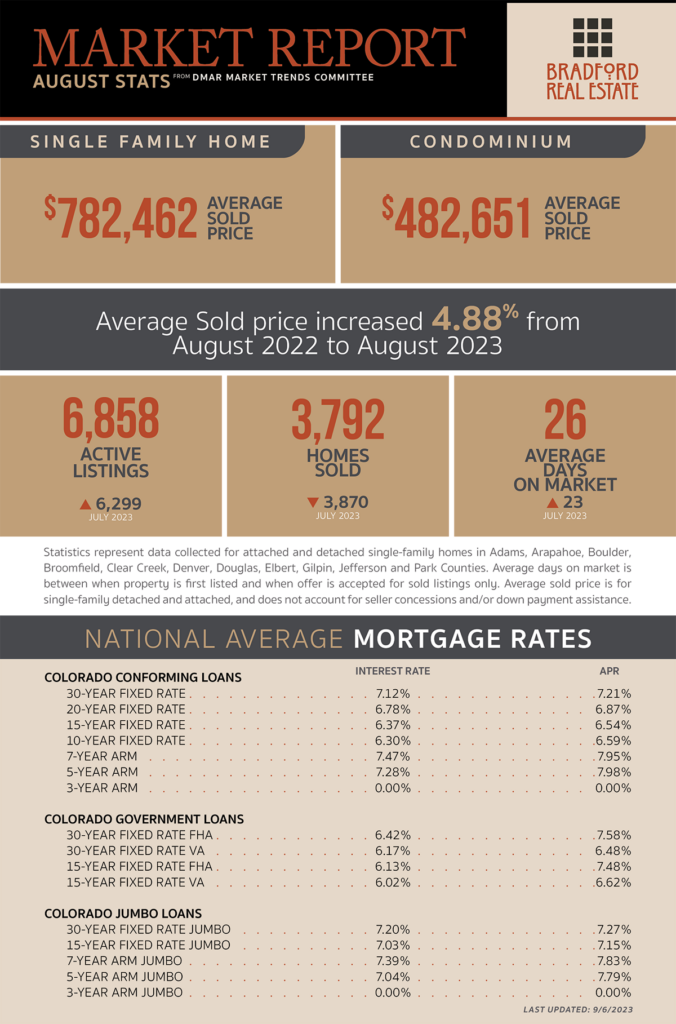

As published in DMAR Market Trends, August 2023

Out of 150 cities, Denver nosedived in ranking from #55 to #99 on U.S. News & World Report’s Best Places to Live annual survey. Boulder, Colorado Springs and Fort Collins all ranked higher.

The Colorado average homeowners insurance premium jumped 23% in 2023 as Colorado ranks #2 for hail claims and #3 for risk of wildfire.

In an effort to combat fraud, 11 Colorado County Assessor Offices currently offer complimentary online resources that enable property owners to register for notifications when a document is recorded concerning their property.

The number of protests filed with Colorado’s 64 county assessors increased 300% in 2023 compared to the average number of protests from the previous three assessment cycles.

According to U.S. News & World Report, both Colorado Springs and Boulder rank in their top U.S. Cities for Singles to Live list.

Many economists predict the housing market is more likely to correct itself from the double-digit percentage jumps in home prices over the past few years rather than crash.

New-build homes accounted for nearly one-third of single-family homes for sale nationwide in May, compared with a historical norm of 10 to 20%.

According to Lawrence Yun, Chief Economist for the National Association of Realtors®, “The recovery has not taken place, but the housing recession is over. The presence of multiple offers implies that housing demand is not being satisfied due to a lack of supply. Homebuilders are ramping up production and hiring workers.”

Denver ranked as the third most competitive rental market in the west, behind Salt Lake City and Tucson.

Denver’s rental licensing requirements for multi-family properties went into effect on January 1, 2023. Rental properties are now the most licensed business in Denver, with 139,000 licensed rental units.

MORTGAGE NEWS

Moving becomes downright unattractive for many homeowners who purchased or refinanced between 2020 and mid-2022 and locked into a mortgage interest rate around 3%.

Mortgage holders who, as of June 2023, stated they had rates higher than 5% are nearly twice as likely to have plans to sell their home in the next three years than those with lower rates.

The Federal Reserve raised the Fed rate by 0.25% from 5.25% to 5.50% and raised the prime rate to 8.50%. HELOC, car loans and credit card interest rates all increased.

30-year fixed mortgage rates started and ended July at 7.04% despite wild mid-month volatility.

Be the first to comment