home

about

properties

contact

blog

Market Insights

November 21, 2022

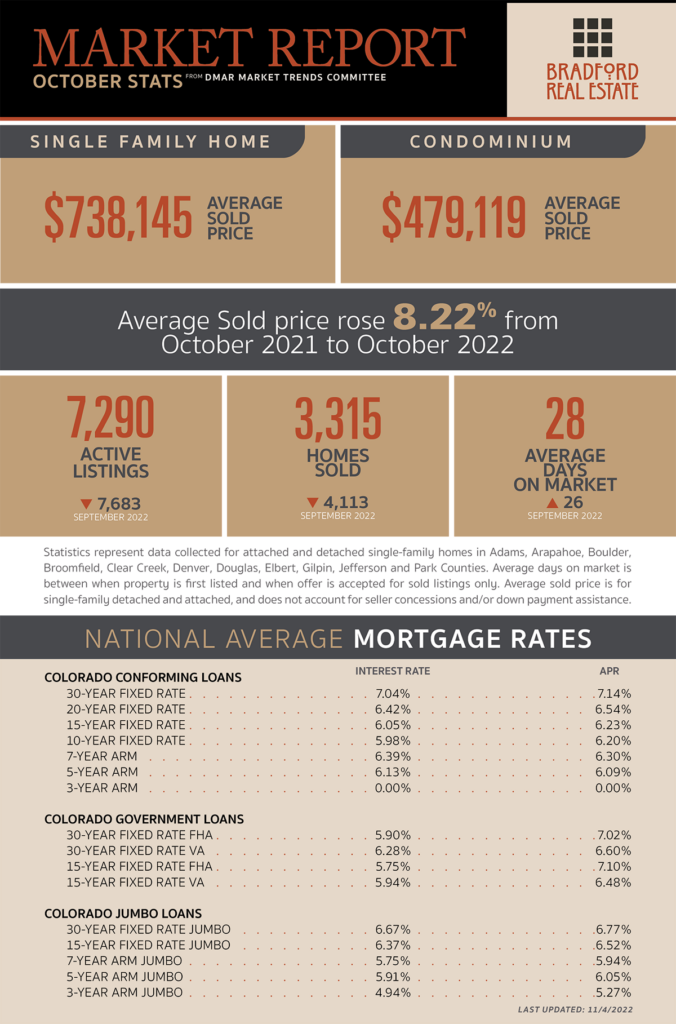

As published in DMAR Market Trends, November 2022

As of October 26, 58.2% of active listings have reduced their asking price, compared to 32.6% last year. Properties that reduced price spent an average of 71 days in the MLS, compared to 36 days for those without price reductions. The pool of potential buyers is getting smaller forcing sellers to compete harder for those remaining buyers.

The historical average decrease in active listings from September to October is 6.63%. A decrease of 5.80% this year represents a slight change from our seasonal expectations.

According to an article in Better Homes & Gardens, the desire for open-concept designs may be shifting back towards traditional floor plans, with defined gathering spaces and definitive rooms.

New construction condo project developers are starting to convert to apartments due to the shift in the market and higher interest rates.

Builders are becoming more flexible with pricing while accepting lower sales prices and offering to help buy down buyers’ interest rates.

Finding investment deals in this market is getting more difficult. While sellers may be willing to sell for less than the peak, investors forecast a future sales price lower than we currently stand.

CoreLogic’s forecast model estimates a large portion of the country will see negative year-over-year home price values over the next 12 months. 2022 is constantly compared to 2021, which was anything but normal, and year-over-year comparisons are painting a deeply negative picture.

iBuyers are not faring well in current market conditions. The Denver Post reported an Opendoor property sold for $154,000 less than it was purchased, while Business Den found that Opendoor lost at least $50,000 on at least 10 of their 36 recent purchases.

MORTGAGE NEWS

FirstBank offers a loan modification on their existing portfolio loans (these loans are going to their ARM products and 15-year fixed loans) which allows borrowers to get current market interest rates on their mortgage without having to go through a full refinance. In other words, there is no underwriting, appraisal, title work, etc. This project is subject to fees.

Be the first to comment