home

about

properties

contact

blog

Market Insights

July 26, 2022

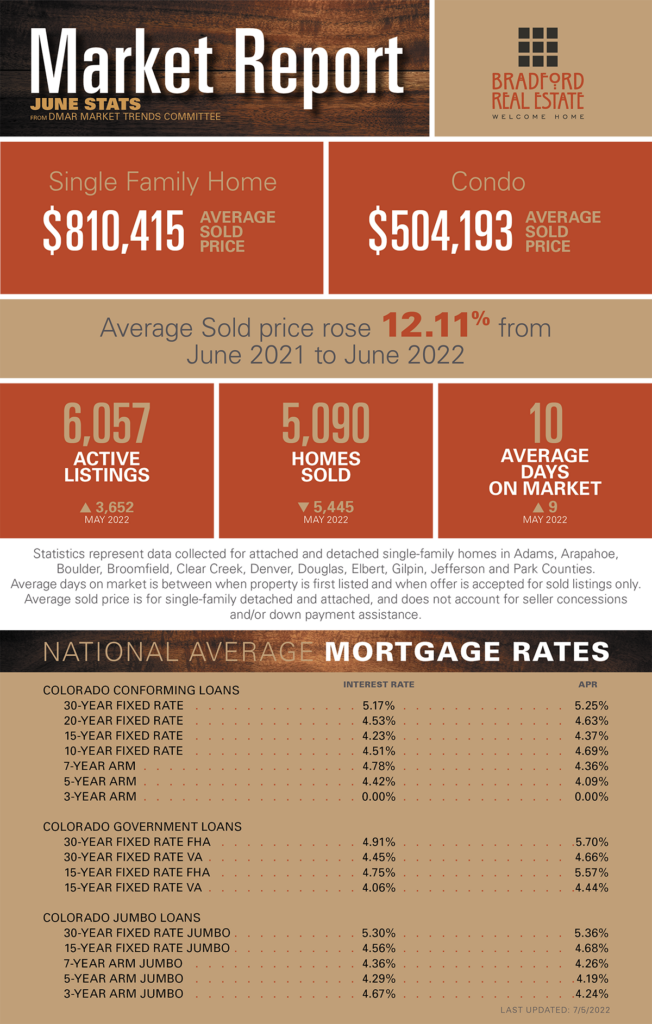

As published in DMAR Market Trends, July 2022

Nearly half of U.S. homeowners plan to upgrade or remodel their homes this year. The trend is most prominent among homeowners between the ages of 25 to 44, who are undertaking the most renovations and looking to bring new trends and renovations to the aging homes they purchase.

Hardwood flooring has long been the top choice for buyers and agents alike and remains so in today’s market. According to one study, finishing hardwood floors yielded 146% cost recovery, and installing new wood floors yielded 118% cost recovery in terms of the increased resale value as compared to the cost of the project. But some less expensive options are gaining popularity. Twenty years ago carpet was in and then hardwoods started coming back. Experts now say we are trending toward the luxury vinyl tile and laminate flooring.

And you thought it wasn’t easy being green! Green is the paint color of the year for 2022.

Denver is the nation’s ninth-best large city for renters, while two neighboring cities are among the nation’s top 50 for renters, according to a recent report from RentCafe. Denver’s local economy was the best performing, and having the 18th-highest number of highly rated schools helped boost the Mile High City’s ranking.

UHaul says its Colorado teams are seeing a stream of one-way outbound moves this year. “In 2022 so far, we have seen Colorado shift from an inbound state to more of an outbound move state,” said United Van Lines Vice President for Corporate Communications. “It’s jumped to 18th on our list, whereas in years past, we’ve seen it more of an inbound move state.

MORTGAGE NEWS

Mortgage rates are always impacted by inflation; however, June saw that impact amplified as the Consumer Price Index’s (CPI) 1% month-over-month increase surprised the market and pushed 30-year mortgage rates from 5.55% to 6.28% in just three days. The opposite happened when the Personal Consumption Expenditures Index’s (PCE) inflation, excluding food and energy, decreased and personal spending was half what was expected. Mortgage rates dropped from 5.9 to 5.5% overnight.

Be the first to comment