home

about

properties

contact

blog

Market Insights

February 19, 2025

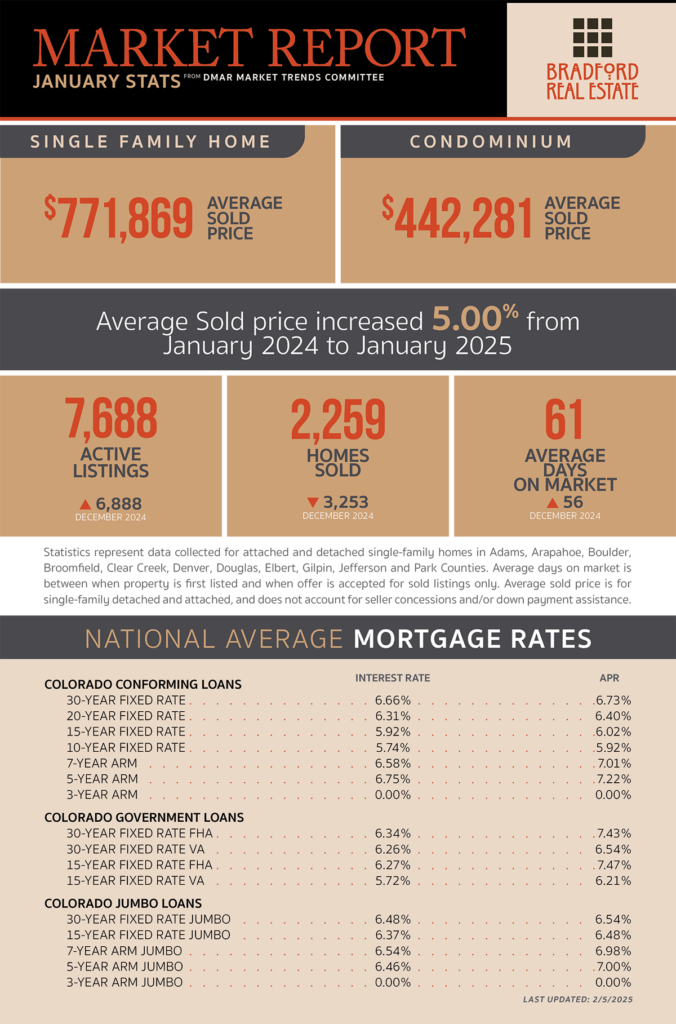

As published in DMAR Market Trends, January 2025

Many experienced agents have more sellers than buyers lined up this year, raising the question: Could this be the strongest spring buyer’s market we’ve seen in the past five years?

Buyer activity feels reminiscent of two years ago, with properties coming to market and moving into pending status within days. Multiple offers are on the rise, though not nearly at the levels seen during the pandemic.

In certain market segments, competition is heating up again, with multiple offers on desirable homes. Well-prepared sellers are making quick decisions, and serious buyers should be ready to act fast—perhaps even dusting off their appraisal gap clause to win a deal.

Colorado’s unemployment rate has risen above the national average for the first time in three years. While sectors like healthcare and government are growing the tech industry has taken a hit.

With the repeal of the Gallagher Amendment, Colorado homeowners face steep property tax increases, even if their home values remain steady due to the lack of a tax limitation structure.

In January, Denver Metro’s multi-unit family market experienced its largest quarterly rent decline on record. A surge in new supply overwhelmed demand, driving up vacancy rates.

In 2025, interior design is all about comfort. Hot trends include “screen,-free” zones for puzzles and board games, along with cozy rooms with plenty of seating designed for relaxation and closeness.

Homeowners Associations (HOAs) have become more common, with 40.5% of listings now in HOA communities—up from 39.2% in 2023. HOA fees are also rising, with the median monthly fee increasing from $100 to $125.

MORTGAGE NEWS

Colorado homeowners remain among the strongest in the country, second only to Washington. Just 1.9% of mortgaged homes in the state are delinquent, and 0.1% are in foreclosure.

After a decline in mortgage purchase applications through December, new buyer activity jumped 27% in early January and has remained steady since.

At its January meeting, the Federal Reserve decided to “wait and see” on rate cuts—an expected move. There is an 83% probability that rates will remain unchanged in March.

Be the first to comment